property tax forgiveness pa

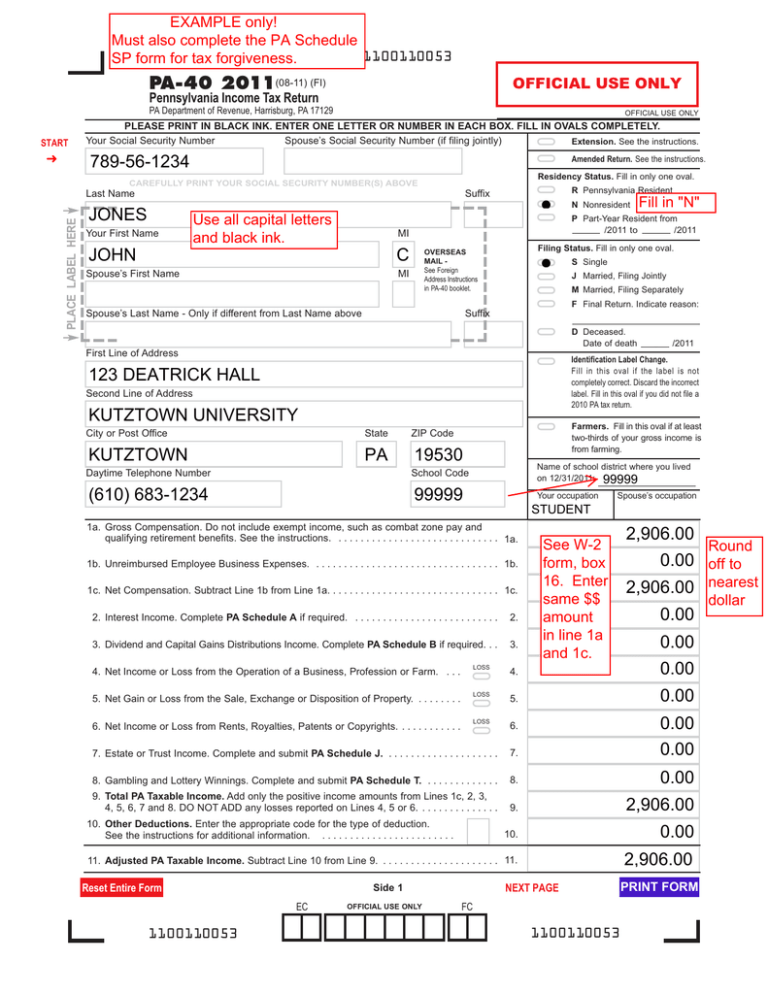

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return.

The level of tax forgiveness is based on the income of the taxpayer and the number of dependents the taxpayer is able to claim.

. 5 2021 pennsylvania enacted act 1 of 2021 act 1 specifically excluding forgiven paycheck protection program ppp loans and economic impact payments 1 from personal income tax pit. Of course the homeowner must have been delinquent on paying their property taxes and it usually needs to be a recent issue and hardship that the person is facing. States also offer tax forgiveness based on personal income standards.

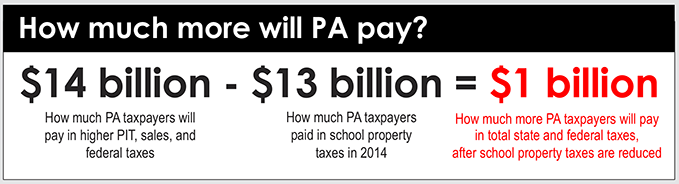

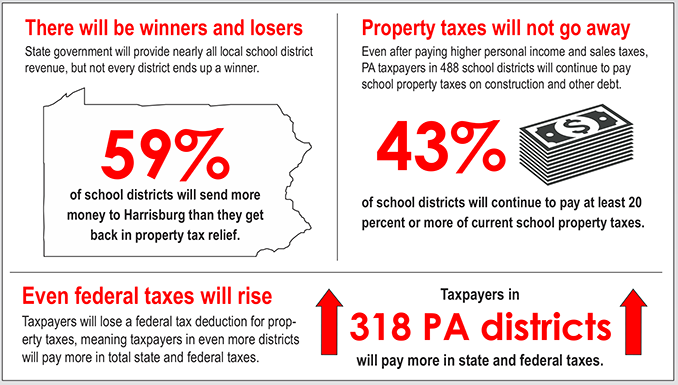

Many Pennsylvanians who may be eligible for a refund or reduction of their Pennsylvania personal income taxes will be receiving letters in the mail. Usually if they miss a single payment then the agreement will be null and voided. Cut school property taxes by 644 billion through an increase in the personal income tax from 307 to 462.

Wolf and his allies laid out a proposal to spend federal pandemic relief money on workers environmental programs and a one-time property tax subsidy for. 2 following the bills enactment the pennsylvania department of revenue pennsylvania department released guidance explaining the provisions of act 1. Mean for school districts 61 Pa.

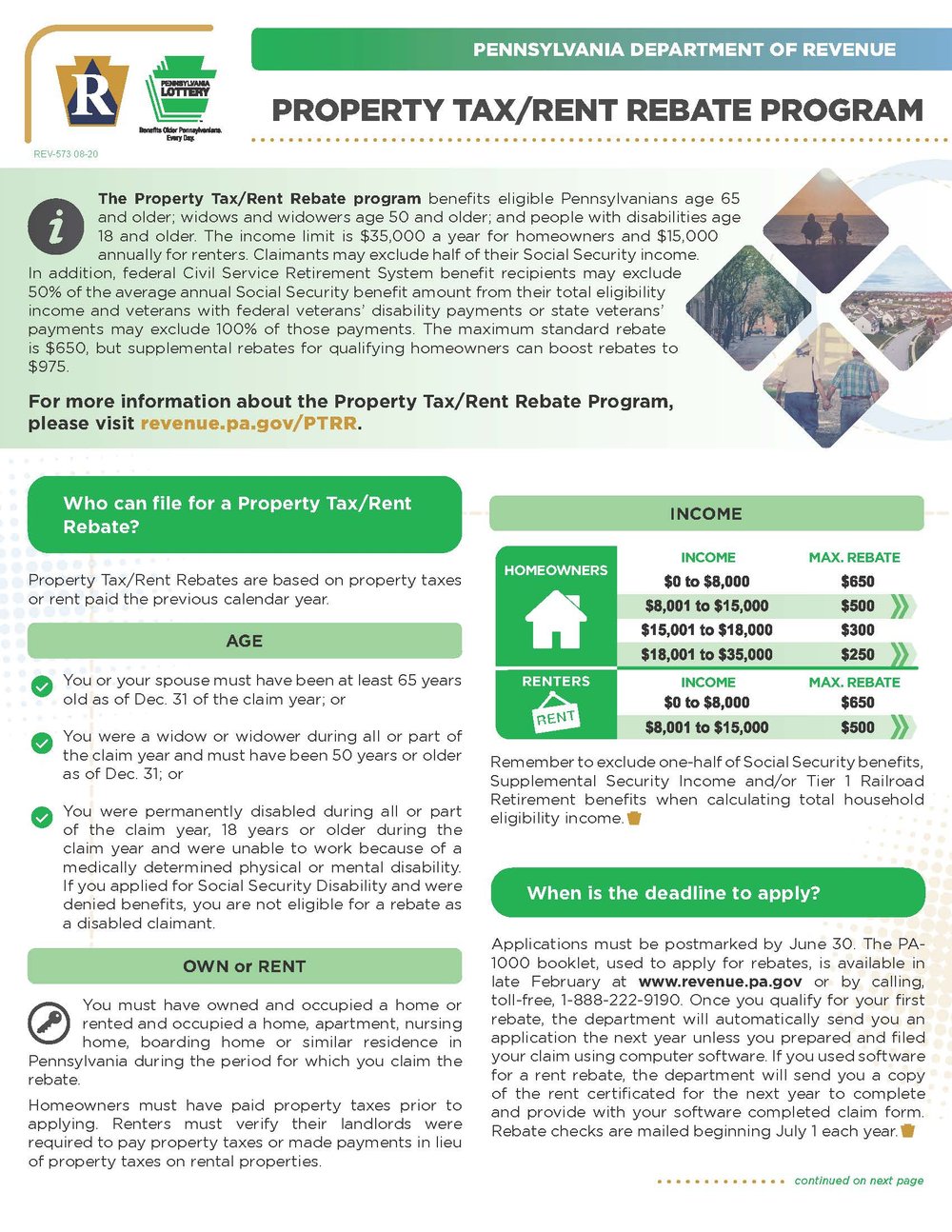

PA Property Tax Relief for SeniorsProperty TaxRent Rebate Program. To qualify for this program you need to fulfill some requirements. If you rent a property your.

Jan 25 2021 0110 PM EST. Property Tax Exemptions for Veterans in Pennsylvania PA disabled veteran benefits include property tax exemptions. Below is a summary of how Pennsylvania tax sales work but tax.

Begin Main Content Area Tax Forgiveness. If youre a disabled veteran with a 100 percent VA disability rating you may qualify for a complete property tax exemption. This can be done in the form of tax credits or exemptions.

Unlike many other states Pennsylvania considers your income for this exemption. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district.

This is a state program funded by appropriations authorized by the General Assembly. For example in Pennsylvania a single person who makes less than 6500 per year may qualify to have 100 percent of their state back taxes forgiven. A waiver of 50 of the total real property taxes and surcharges which have been outstanding for more than 180 days PROVIDED THAT full payment of all sums due and owing is made on or before 31 May 2021.

Received Honorable or Under Honorable Conditions discharge Served during a period of war. In case you are a senior citizen living in Pennsylvania you should know that you may be eligible for a rebate on your property taxes or rent. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners as well as disabled veteran homeowners or their surviving spouses.

Raise the personal income tax from 307 to 432 and cap the rebates for homestead properties at 2340 effectively eliminating school property taxes for more than 2 million homeowners. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery. These standards vary from state to state.

The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975. Accordingly failing to pay your real property taxes in Pennsylvania could lead to an upset tax sale or a judicial tax sale and the loss of your property. State Tax Forgiveness.

Tax collecting officials including county trustees receive applications from taxpayers who. Property Tax Penalty Forgiveness - Cherry Township PA Property Tax Penalty Forgiveness Posted on December 8 2020 The penalty for real estate taxes was forgiven through November 30 2020. Heres what you need to know about the Property TaxRent Rebate Program in Pennsylvania Pennsylvania News readingeagle What is the Homestead Exemption in Real Estate Millionacres Property Tax Rent Rebate Form Pa Detroit property tax assessments to decline as 62 What would no property taxes in Pa.

Since the programs 1971 inception older and disabled adults have received more than 71 billion in property tax and rent relief. It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired. Up to 25 cash back All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes.

Then move across the line to find your eligibility income. Provides a reduction in tax liability and Forgives some taxpayers of their liabilities even if they have not paid their Pennsylvania personal income tax. A dependent is defined to be a child who can be claimed as a dependent for federal income tax purposes.

Tax relief can be a big help because it can reduce or even completely negate the taxes you owe. Property Tax Relief Through Homestead Exclusion - PA DCED Homestead Tax Exemption About The Taxpayer Relief Act The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Real Estate Tax Exemption The program provides real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has a financial need.

If you own your home your annual income cannot be more than 35000. Taxes paid in December will now be assessed the penalty amount and those taxes must be paid by December 31 2020. For example 10 means you are entitled to 100 percent tax forgiveness and 20 means you are entitled to 20 percent tax forgiveness.

The homeowner will need to pay each and every monthly or quarterly installment on time. WTAJ Older Pennsylvanians and Pennsylvanians that have disabilities are now eligible to apply for rebates on their property taxes or. At the bottom of each column is an amount expressed as a decimal which represents the percentage of tax forgiveness you are allowed.

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Property Tax Bill Will Cost Pa Taxpayers More

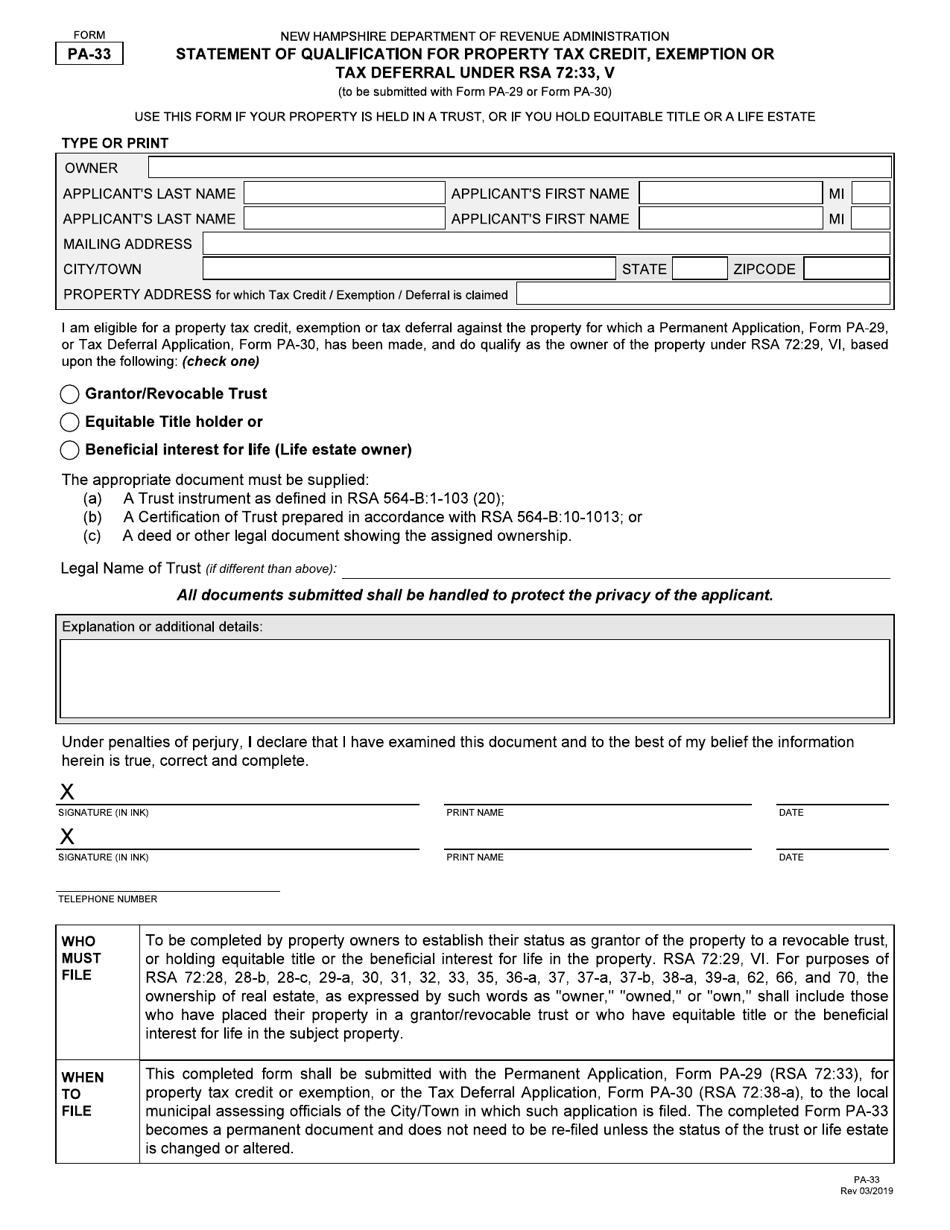

Form Pa 33 Download Fillable Pdf Or Fill Online Statement Of Qualification For Property Tax Credit Exemption Or Tax Deferral Under Rsa 72 33 V New Hampshire Templateroller

.jpg)

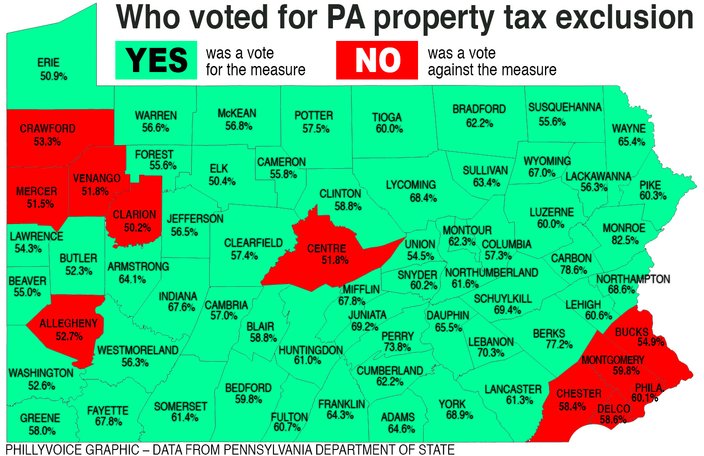

Pa State Rep Property Taxes Time To Eliminate

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

School District Taxes West Mifflin Area High School

Map Here S Who Voted For Property Tax Exclusion In Pennsylvania Phillyvoice

Property Tax Bill Will Cost Pa Taxpayers More

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

Pa Budget Battle Is Covid Relief Money The Cure For Property Tax Rates Gop Says No Dems Say Yes Pittsburgh Post Gazette

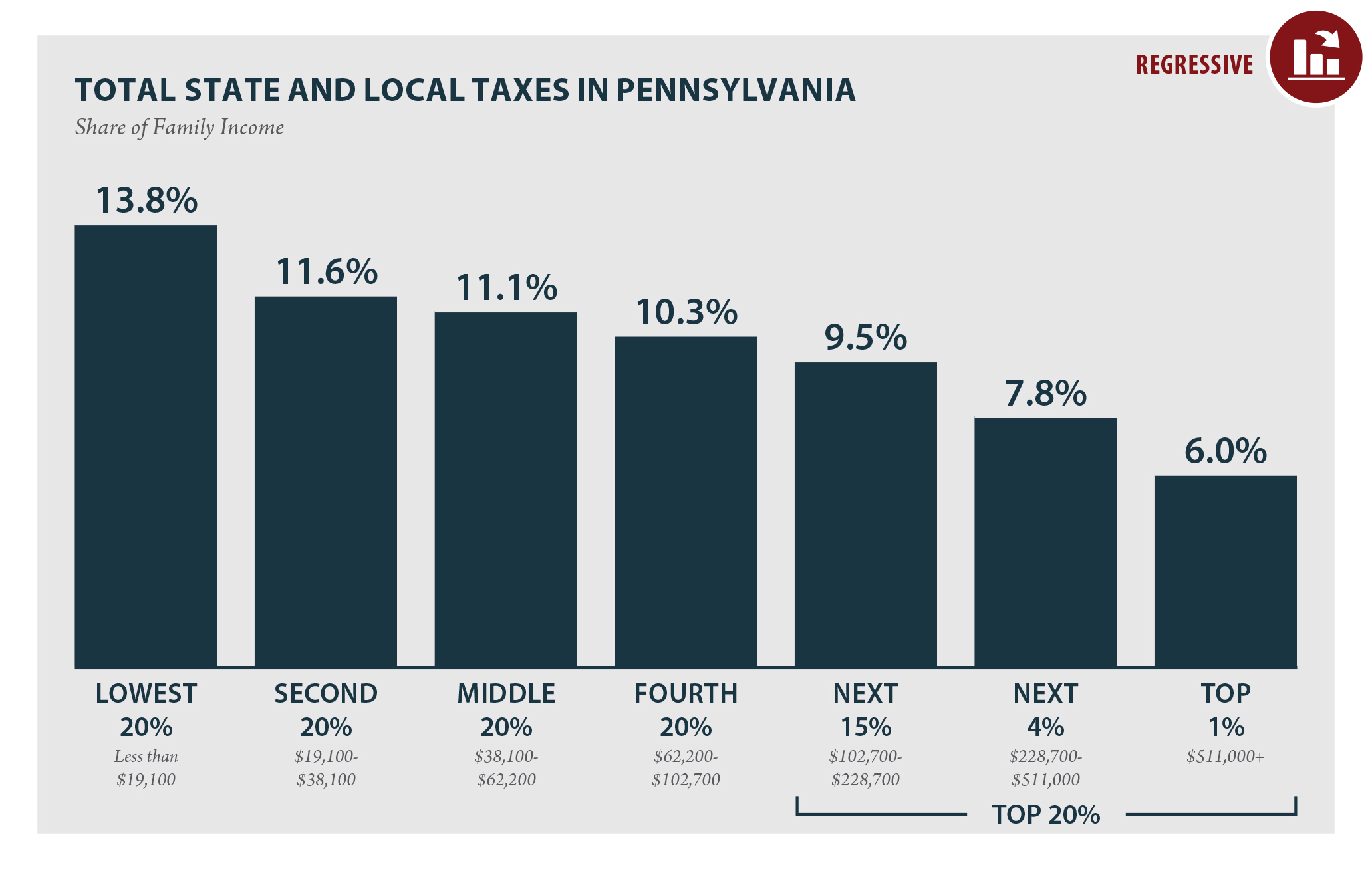

Pennsylvania Who Pays 6th Edition Itep

Free Form Pa 1000 Property Tax Or Rent Rebate Claim Free Legal Forms Laws Com

Get And Sign Pa 1000 Form 2018 2022

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania